The coronavirus pandemic has had far-reaching impacts on the business of property managers, owners, and management companies. To help mitigate some of the effects on our members and their businesses, IREM, along with other industry organizations, have been advocating for support and relief for the real estate industry. See below for IREM’s advocacy initiatives relevant to the COVID-19 pandemic.

IREM® Statement on Supreme Court Decision

On August 26th, the U.S. Supreme Court ended the federal moratorium on residential evictions.

In a 6-3 ruling, a majority of justices agreed that the stay on the lower court’s order finding the CDC’s eviction moratorium to be unlawful was no longer justified.

IREM applauds the Supreme Court's decision as it is the correct one, from both a legal standpoint and a matter of fairness. It brings to an end an unlawful policy that places financial hardship solely on the shoulders of mom-and-pop housing providers, who provide nearly half of all rental housing in America, and it restores property rights in America.

We now look forward to working with the Administration, Congress, states, and localities to help disburse rental assistance funds to residents and housing providers in need. IREM is committed to working with all our government agencies to ensure the emergency rental assistance program is a success, to help our residents regain housing stability, and to preserve the viability of the rental housing sector.

The expiration of the federal eviction moratorium is an important catalyst to returning renters to a normal payment schedule and thus providing stability to the housing providers who have been damaged by revenue losses and who may be struggling to pay their mortgages, finance property operations, and meet their own financial obligations.

Members can contact Ted Thurn, IREM Director of Government Affairs at tthurn@irem.org with any questions.

Webinar recording: Ending of the Federal Eviction Moratorium – What Property Managers Should Know & Best Practices to Follow

With the federal eviction moratorium set to expire on October 3, prep yourself and your staff for handling evictions with the best practices from this webinar, hosted on August 3.

COVID-19 Relief Package and Emergency Rental Assistance

The latest COVID Relief Package, signed on Dec. 28, 2020, contained $25 billion in Emergency Rental Assistance to assist households that are unable to pay rent and utilities due to the COVID-19 pandemic.

Emergency Rental Assistance payments will be made directly to States (including the District of Columbia), U.S. Territories (Puerto Rico, the U.S. Virgin Islands, Guam, the Commonwealth of the Northern Mariana Islands, and American Samoa), local governments with more than 200,000 residents, the Department of Hawaiian Home Lands, and Indian tribes (defined to include Alaska native corporations) or the tribally designated housing entity of an Indian tribe, as applicable (collectively the “eligible grantees”). The funds will be allocated to states through the Department of Treasury.

Although the legislation mandates that each state receive at least $200 million in assistance, the bill allows states to receive further funding. In order for your state to receive the maximum amount of assistance, states and localities (“eligible grantees”) must submit an application to the Treasury Department by 11:59 p.m. EDT on January 12, 2021.

Contact your governor immediately and encourage them to apply for federal rental assistance.

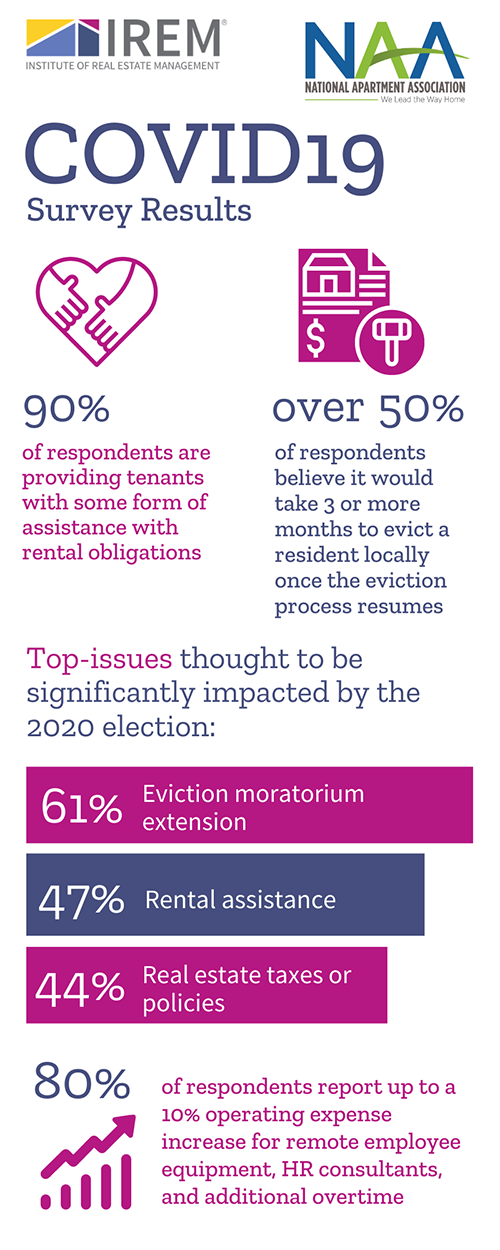

IREM & NAA Survey Results

NAA and IREM, in partnership with CEL & Associates, Inc., are conducting a brief monthly survey of apartment owners and operators to collect data on the impact of COVID-19 to the rental housing industry. Highlights from September’s survey are available in the following infographic along with full results from all months linked below.

Survey results: April

Survey results: May

Survey results: June

Survey results: July

Survey results: September

CDC Executive Order and IREM actions

The Trump administration announced that the Centers for Disease Control and Prevention (CDC) issued an Order under Section 361 of the Public Health Service Act to halt residential evictions through December 31 to prevent the further spread of COVID-19. The order halts residential evictions if the tenant provides the landlord with a document in writing which indicates:

- They have used all efforts to obtain government assistance for rent;

- They earn no more than $99,000 in income (or $198,000 if filing jointly);

- They are unable to pay the full rent due to loss of income, loss of work, or extraordinary medical expenses;

- They are making best efforts to make a timely payment; and

- That eviction would render them homeless or need to move into a new residence shared by other people who live in close quarters because I have no other available housing options

Download the eligibility criteria document.

The order, issued by the Centers for Disease Control and Prevention (CDC), is effective immediately. In response, IREM joined NAR in a statement urging immediate Congressional action on rental assistance. We also encourage members to participate in our Call to Action asking for rental assistance for property owners and managers. Further, IREM signed onto a letter with our coalition partners, which include NAR, NAA, NMHC, NAHB, Mortgage Bankers Association, and many others.

IREM members, including 2020 President-elect Chip Watts, CPM®, CCIM, IREM Past President Donald Wilkerson, CPM®, and Amy Hedgecock, CPM® joined a group of NAR (National Association of REALTORS®) representatives in a meeting with White House officials on Tuesday, September 15 to address concerns over the CDC executive action. Leaders from IREM and NAR urged members from the National Economic Council and White House Office of Domestic Policy Council, about the need for a more sustainable long-term solution. An eviction moratorium, combined without an emergency rental assistance plan, places the stability of the entire rental housing sector in danger.

“IREM will continue to make the case to the White House, Congressional leaders, the CDC, and any other federal agency about the need to pass a robust emergency rental assistance plan,” says Chip Watts. “Not only does the housing industry need a plan that provides the necessary and essential help to housing providers, one needs to be created that provides funds directly to property owners to ensure financial obligations are being met.”

IREM is committed to ensuring Americans have a safe, secure place to call home. IREM will continue to work with NAR and our other coalition partners to ensure essential relief is provided to help the housing sector maintain housing availability and security for the millions of Americans that we serve.

America’s Recovery Fund

IREM is a part of America’s Recovery Fund Coalition, which is advocating for federal grants to help businesses cover some of their operational expenses. America’s Recovery Fund provides funding to help America’s businesses to retain and rehire staff, pay rent, adapt to new requirements, meet certain debt obligations, and pay state and local taxes. The fund will include strict federal oversight and anti-abuse mechanisms. It will be a vital lifeline to businesses, communities, workers, and state and local governments that rely on their success to support local economies.

What is the recovery fund and why is it critical to getting back to work? Take a look at this infographic to learn more.

Federal guidelines for reopening America

Yesterday, the White House announced guidelines for states and counties to reopen businesses in phases based on various health and testing criteria. The new guidelines, formally known as Opening Up America Again, allow governors some discretion to decide how to restart state economies amid growing fallout from the COVID-19 outbreak. President Trump acknowledged the continued risk posed by COVID-19 and said Americans should continue to practice pronounced hygiene practices, including social distancing and teleworking.

The President expressed optimism that as many as 29 states could be ready to open their economies in the coming weeks, though he declined to provide specifics. The White House guidelines say states should move to the first phase of reopening after exhibiting a downward trend of documented cases or positive tests over a two-week period.

Opening Up American Again

Paycheck Protection Program and Financial FAQs

Bank regulators have also adopted many new policies in light of needs COVID-19. The National Association of REALTORS® has compiled these provisions and actions that are designed to address homebuying, homeowner/landlord, and personal finance issues.

For those applying to the Paycheck Protection Program, the U.S. Department of Treasury has added the following resources to its Paycheck Protection Program website:

- New Lender Application Form (Federally Insured Depository Institutions, Federally Insured Credit Unions, Farm Credit System Institutions)

- Interim Final Rule

- Interim Final Rule on Affiliation

- Applicable Affiliation Rules

- Frequently Asked Questions

- Find an eligible lender

The U.S. Small Business Administration, in consultation with the Department of the Treasury, posted a revised, borrower-friendly Paycheck Protection Program (PPP) loan forgiveness application implementing the PPP Flexibility Act of 2020, signed into law by President Trump on June 5, 2020. In addition to revising the full forgiveness application, SBA also published a new EZ version of the forgiveness application that applies to borrowers that:

- Are self-employed and have no employees

- Did not reduce the salaries or wages of their employees by more than 25%, and did not reduce the number or hours of their employees

- Experienced reductions in business activity as a result of health directives related to COVID-19, and did not reduce the salaries or wages of their employees by more than 25%

The EZ application requires fewer calculations and less documentation for eligible borrowers. Details regarding the applicability of these provisions are available in the instructions to the new EZ application form.

CARES Act

On March 27, 2020, President Trump signed into law Coronavirus, Aid, Relief, and Economic Security (CARES) Act, creating $2 trillion in aid for businesses and individuals. Congressional leadership has signaled that an additional relief package could be ready before legislators return to Capitol Hill.

We would like to thank the National Association of REALTORS® and the Real Estate Roundtable for their contributions to these summaries of the primary CARES Act provisions impacting the commercial real estate and property management industries.

Advocacy letters

IREM has signed onto letters to Congress and other government agencies advocating for relief for the real estate industry and 501(c)6 organizations. You can view the letters IREM has signed onto below:

Extension for 1031s & Opportunity Zone Funds

Great news for our IREM members! The IRS Treasury and IRS extended deadlines applicable to 1031 like-kind exchanges and opportunity fund investments that are already underway.

IREM signed onto letters requesting an extension 1031 like-kind exchanges and opportunity fund investments. IREM and our coalition partners advocated how these programs are designed to promote economic growth in communities, and investors in these programs should not be harmed due to the effects of COVID-19.

The IRS provided additional pandemic-related relief to Opportunity Zone investors and opportunity funds. IRS Notice 2020-39 includes five key changes and clarifications:

- If the 180-day investment period to roll gain into an opportunity fund would have expired between 4/1/20 and 12/31/20, the deadline is extended to 12/31/20.

- If an opportunity has a compliance date for the 90% investment asset test that falls between 4/1/20 and 12/31/20, failure to comply is automatically excused under the reasonable cause exception.

- The 30-month substantial improvement period for real property owned by an opportunity fund or opportunity zone business is tolled from 4/1/20 through 12/31/20.

- The IRS has clarified that the working capital safe harbor for opportunity fund working capital assets is extended under the President’s emergency declaration by 24 months (for a total period of 55 months) if the working capital is held by the fund before 12/31/20 and the other requirements for the safe harbor are met.

- The 12-month period for an opportunity fund to reinvest proceeds from the return of capital or disposition of property is extended by an additional 12 months if the original period included 1/20/20, the date of FEMA’s major disaster declaration and other requirements are met.

From the Front Lines

Fannie Mae and Freddie Mac will offer multifamily property owners mortgage forbearance

To support multifamily property owners during this national emergency, the Federal Housing Finance Agency (FHFA) announced that Fannie Mae and Freddie Mac will offer multifamily property owners mortgage forbearance with the condition that they suspend all evictions for renters unable to pay rent due to the impact of COVID-19.

Forbearance is available to all multifamily properties with a Fannie Mae and/or Freddie Mac-backed performing multifamily mortgage that has been negatively affected by the coronavirus national emergency.

Mortgage Help for Homebuyers Impacted by COVID-19

Other coronavirus advocacy resources

California Pandemic Roadmap

CARES Act Summary

COVID-19 Cumulative Adjourned State Legislation Report

COVID-19 Cumulative Federal Legislative Report

COVID-19 Cumulative In Session State Legislation Report

COVID Map

COVID-19 Major Enacted State and Federal Legislative Action Center

COVID-19 Pending and Enacted State Legislative Report

COVID-19 Pending and Enacted Federal Legislative Report

FHFA Mortgage Forbearance

HUD COVID-19 Multifamily Guidance (Recording)

NAR Flash Survey Results – April 5-6, 2020

NAR infographic on SBA loan types

Paycheck Protection Program (PPP) application

Small Business Administration CARES Act Flowchart

Small Business Administration – Paycheck Protection Program Report (approvals through 4/13/2020)

Small Business Assistance – U.S. Department of Treasury

Urban Institute – Avoiding a COVID-19 Disaster for Renters and the Housing Market

U.S. Chamber of Commerce Coronavirus Emergency Loans Small Business Guide and Checklist

U.S. Chamber of Commerce State-by-State Business Reopening Guidance

U.S. Senate Small Business Committee FAQs